It has been a quite a long time since I had written a blog. My apologies to readers. Due to personal reasons I was totally out of touch on blogging.

Last few months have been completely a downhill ride for me (and some of her lenders I know). I personally feel, I am let down by what has happened recently with us. I will touch base on that later in the blog. Let’s start with the big news. RBI’s lending guidelines are finally out and there is a lot to process.

Decoding the RBI guidelines

Firstly, P2P platforms will be classified as special type of NBFCs: NBFC-P2P, and they need to fit into all the stated regulation by RBI within 90days of release of the notification. i.e. by 4th January 2018.

Secondly, the 2Cr equity investment is must. A lot of firms have managed to raise that much capital. Some through personal money, some through Angel Investors, some through Venture Capitalists.

Thirdly, platforms are obligated to notify all loans to credit bureaus, which a good news. This acts as a deterrent for borrowers to default. Even though platforms cannot offer principal protection guarantee, they can offer insurance for a premium. Thus creating some sort of safety net for lenders. This is potentially a good way for platform to differentiate themselves against their competitors. Who and How the insurance products will be designed is up to them. But I do believe there is a big opportunity here platforms to provide insurance and suggest lenders to buy insurance for all their loans.*

(*I have now no commercial gains for providing this suggestion)

Fourthly, a set back for major lenders. A personal lender cannot lender more than INR 10Lac (1 Million). Which I believe is a very low amount. And now lender cannot give more than 50,000 a borrower, which seems fair. I think platforms are requesting RBI to raise the INR 1Million cap or not have the cap at all.

Fifthly, on the default management side, RBI has said: “platforms shall render services for recovery of loans originated on the platform.” Also they have elsewhere in the regulations mentioned: “The outsourcing of any activity by NBFC-P2P does not diminish its obligations and it shall be responsible for the actions of its service providers including recovery agents”. This is fairly straightforward interpretation:

1. Platforms must render recovery services

2. Platform can outsource recovery services

3. Platform is held responsible for actions of the service provider i.e. Recovery Agency

Thus it is the prerogative of the platform to provide recovery. A lot of platform owners will try to dilute the interpretation, you stick to it. You can also challenges the same at RBI’s consumer redressal appeal which can be filed online. Recovery is not always successful but not making a serious attempt by the platform to recovery must be dealt seriously. Platforms can use mischievous stalling techniques and you get nothing in return. Sending chaser emails and calling in not even soft recovery; sending legal notice, police and recovery agent visit, filing legal case or arbitration case this is what real recovery looks. Recovery is not 100% possible in all cases, as the borrower might be in serious trouble but restructuring of loan especially for salaried borrower is always possible.

Fifthly, portfolio assessment must be provided by the platform each month including listing out of NPAs, fees charged, interest income earned, outstanding loan amount, EMI received. You have the right to ask the platform a detailed assessment of your entire portfolio, as the guidelines. The platforms can’t refuse. Some of them email you each month some of them post it on their website. NPAs needs to be segregated by age: non repayments above 90days is classified as default and needs to go to full recovery.

The regulations have clarified lot of issues of portfolio management and NPA resolution. The regulations are evolutionary in nature and RBI will keep on clarifying portions are that are open to extreme interpretation. The key areas is the handling of defaults that need more direction of RBI. If the firm fails to send a loan to recovery what options do the lenders have: can lenders direct platform to initiate recovery, can they file a complaint with RBI, what can lenders do in case the initiated recovery is good enough and that the recovery agency is lax. These questions needs to be answered.

Overall, the regulations are balanced and enough space has been given for platforms and lenders to manoeuvre. But hopefully the platforms do not take lenders for a ride with their mis-representation and hysterical interpretation of regulations.

Automated Investment

Few platforms have started to provide auto investment feature. This is especially for those who understand the nuances of personal lending and have large portfolio (say >5L), although lenders with lesser amount can also make use of it.

The Basics

The idea of auto investment is pretty simple. Most of the platforms have their algorithm that is used to analyse a borrower and give it a rating and interest rate. Rating generally range from 1(least risky borrower) – 7 or 8 (most risky borrower) and the interest rate charge is proportional to the rating – higher the rating higher the interest rate.

Based on lenders appetite, he or she can choose in types of borrowers based on rating to invest and give each rating a weightage. The total weightage should add up to 100%. For example, if I choose to invest in borrowers ratings 1,2,3 only, I can assign weights 30% to 1, 30% to 2 and 40% to 3. Thus my overall portfolio would be have 1,2,3 borrower types with their stated weights. The platform also show the net ROI upon borrower selection.

Advance Automated Investments

Some of us want to have more control over the kind of borrowers we want to lend to. This may involve lending to borrowers having a certain minimum salary, for example. Or, not to lend to someone who lives in rented home.

These are very specific or advanced filters. A borrower may have a CIBIL of 700+, rating of 1 on a platform, but because lives in they are bachelor who move town often, they would be rejected. For platforms it does not make sense to create such kind of filters. This is way they would reject too many.

One a major advantage of Automated Investment is that you don’t have to worry about reinvesting your EMI into new loans, the platforms does it for you. That results in faster funding for the borrower too. However, while investing one should always put hard thought to diversification. I wouldn’t suggest to just put in the money in auto investment select parameters and then let the platform take over. I rather suggest to start with the least riskiest borrowers and steadily move towards riskier borrowers over a period of time. And let the portfolio lean towards least risky and low yield borrowers and then move towards high risky borrowers for better yield. This can be done by adjusting the weights to ratings overtime.

Capital Recovery

I have spoken about exiting from the p2p asset class here, in this blog. If you are don’t think p2p is for you or have faced large defaults, you might want to quit it lending.

Loans given can be up to 36 months. So if you last loan given had a tenure of 36months. It’s going to take 3 years for you to get your entire principle back, provided the borrower does not default, or recloses the loan.

In case you have defaults of more than 10%, I suggest either two:

1. Quit p2p lending

2. Or figure out what was wrong with your earlier strategy and give it a go again.

If you wish to quite lending, it’s fairly easy. You stop lending. The hard part is that you get back you principle amount. For that you might have to wait up to 36 months, at least. Over the time it is going to be very painful for you to wait and watch for your investment to come back. It is very easy to disburse, but very hard to get back the investment. You will have be very patient but very aggressive at the same time. What is important is that you remain on top of the default loans; that you are constantly asking the platforms to show progress in the recovery of loans. If the platforms are refusing to share recovery details or are not pursuing recovery despite several attempts by you, you should file a case with RBI, send the platform legal notice and do not engage in their game of keeping you wait forever till nothing happens and your finally just give up.

To reconfigure your strategy, I suggest so with the highest rated (rating 1,2, and 3) borrowers only for a year. A diversified portfolio loan rating 1,2,3 should not give your default rate of more than 5%. Ask the platform so provide, in writing the default rates for these loans and diversify your loans with minimum investment in each loan so that your portfolio mimics the platforms portfolio for these loans. In my experience most loan defaults happen during the mid term of the loan, because the loan now has become a drag on the borrower. If your least risky borrowers are defaulting, then there is something wrong with the underwriting of the platform and you should stop investing.

If you are driving below speed limit, wearing a seat belt, and have air bags in your car and yet you get injured, it’s time to get out of the car and change it. As Buffet said, you lost money somewhere, that thing won’t help you get back your money in the long run.

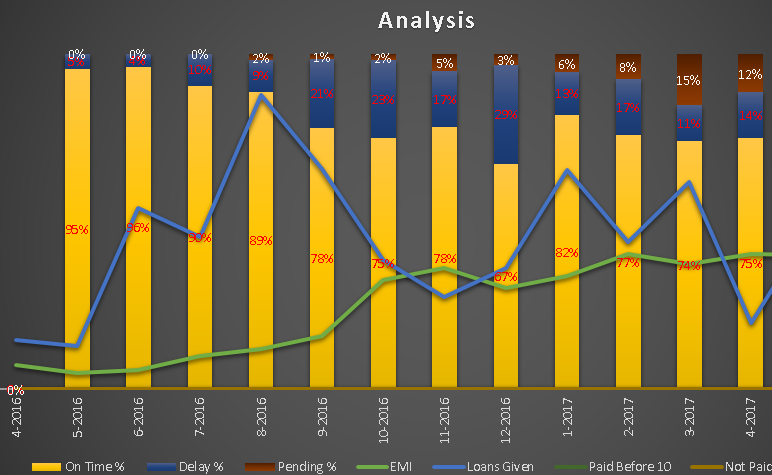

What makes an ideal borrower, who is an ideal borrower is a question that all lenders ponder upon. An ideal borrower is one who simply pays all EMIs on time, without days. Hassle free.

What makes an ideal borrower, who is an ideal borrower is a question that all lenders ponder upon. An ideal borrower is one who simply pays all EMIs on time, without days. Hassle free.