In his recent interview by Lending Club’s new CEO, Scott Sanborn, to Forbes magazine, (Here): “Lending Club is a two-sided marketplace model where we’re able to leverage technology to deliver savings and a seamless online experience to both borrowers and investors. We remove structural inefficiencies, giving retail investors unprecedented access to consumer credit”

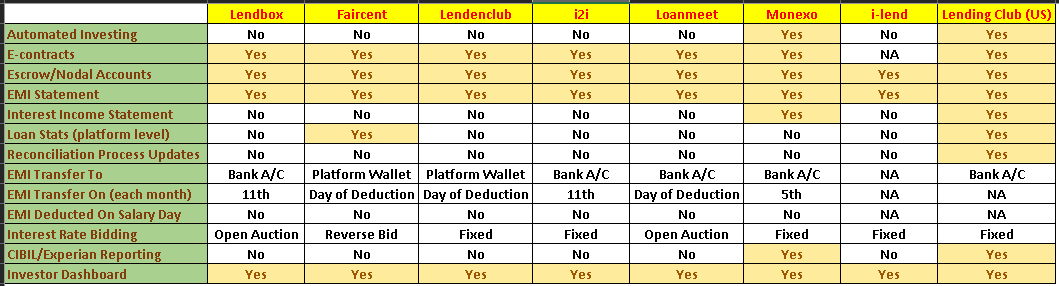

The key term being “seamless online experience” to both borrowers and lenders. I started to wonder how seamless is the experience on the p2p marketplaces in India. What came out of this research is the table you will see below. This allows us to see how differentiated each platform is and where the competencies of these platform might lie.

So are Indian marketplace positioned to deliver an “seamless experience”?

Of course, they can’t be as good as LC, as of now! LC has automate investing, solid recollection process and update, openly showcases stats about their lending activities, emi collection and disbursal is smooth, no hassle there, with a click info about interest income and taxes is available, all agreements are digital and e-signed. The minimum ticket size $50 (~INR 3000) and has ability to diversify easily. But in future, why not!

Based on my observation, Below is table I have made. It describes, how on various levels are each platform is different from the other. These are the platform I have heard and read about, not necessarily all the platforms in India.

The gap is quite wide for most the players compared to LC. But no complaints yet, cause LC is a decade old, Indian platforms are hardly 2 year old.

Firstly, a quick view shows, Monexo is the only platform, yet, to offer auto investment and does CIBIL/Experian reporting. It’s auto invest feature is based on platform rations (M1-M8) and bid size. I am told they are build a bit more sophisticated auto-invest. All the other platforms have this in their pipeline and we might see it soon.

Secondly, a recent debate has propped up. One of the debates between the lenders is whether the amount should be credit to the platform wallet or lender’s bank account.

From the platform’s point of view, they probably believe the EMI should be available in their own wallets so that the money is reinvested in borrower’s from their platform and without much hassle.

From the lender’s point of view, they want to lend to credit worthy borrowers on which ever platform they are. Thus, anyone who is lending on more than 3 platforms has the hassle of managing wallets. As of now I always ask for my amount to be credited back to my bank account, so that I can route it whenever I want to borrower of any platform.

Another striking thing to note is that none of the platforms deduct EMI on date of salary, I believe this should be the case to reduce bad delays and defaults – debit the EMI as soon as salary hits their account.

Thirdly, there is a wide gap on when EMIs are transferred to lenders. Some platforms transfer it on a particular date of each month, while others transfer on ad-hoc basis.

Again a tricky thing for lenders. Ideally a lender would want one single payment in their bank account to be credited on or before 11th along with a “statement of emi and interest” for that particular month.

I put forth a lot of needs from a lender point of view. Why so? Cause the idea is to have a smooth, hassle-free lending experience not cumbersome, tedious and frustrating experience. This is how platforms can differentiate itself and attract more lenders.

The interest rate bidding is also interesting to see! I am not a fan of reverse bidding model cause the idea is to have fair deal for lender; a borrower with high credit risk may get an interest rate which is lower the benchmark range for it’s type of borrower. For example, a borrower with highest risk rating should not be charged less than say 24%, which is it’s assigned rating. If 21%-24% is the IR benchmarking for medium risk borrowers, and if the highest risk rated borrowers get say 23% (owing to reverse bidding), then it’s not fair deal for medium risk borrower who might get 24% and the lender too! The risk reward angle is skewed here.

On the contrary the fixed rate model is purely based on credit algorithm of the platform which is “supposed” to undertake all kinds of risk into account. The open auction model, allows lenders to determine their risk-reward appetite and then bid.

In essence, reverse bid models and skewed, open auction are pro-lender and fixed rate is “supposedly” balanced.

So, for the concluding remarks, the gap between LC and Indian p2p players is wide but within reach. The platform that provides simple, elegant and seamless experience will win the race to get more attention of lenders. Most lenders have after all p2p as a side activity, and this should not consume their free time or clash with their day-to-day working hours.